When an FX transaction reaches maturity date, it must be settled to be completely over, except if you are planning to carry it forward. The settlement also updates the exchange position. It is required for all FX Transactions, except Spot Exchange Transactions, for which there is no actual settlement.

You can settle one or several transactions:

- manually, either for a selected transaction or by batch, i.e. for several transactions at once.

- automatically for early settlement or carry forward (partial or total).

The transactions meeting the following requirements are the only ones that can be settled:

- they are back-office validated,

- the accounts of their company (and their counterparty, if any) as well as the dates of their effective currency delivery are entered.

For more information on back-office validation and modification of Forward Exchange Transactions see topics Forward exchange and Back-office Validation.

Once settled, transactions cannot be modified, nor deleted. However, you can view and print the associated documents.

After the settlement, the exchange position of the settled transaction goes from the FX position:

- to the Stock if one of the cash flows has the "Forecast" status,

- to the Global Bank Balance if the cash flows have the "Actual" status.

The flows from Cash are updated on the basis of the settled transactions, at the defined dates and on the accounts specified in the Settlement tab of each transaction.

When all the flows linked to the transaction have the "Actual" status, the transaction are automatically settled.

- In the management page for Forward Exchange Transactions, click the Change button in the filters toolbar.

The modification page for the current filter is displayed.

- Click on the Advanced tab.

- In the Status area, select the option:

- Opened to select the non-settled transactions only,

- Closed to select the settled transactions.

- Click OK in the actions toolbar.

The management page for Forward Exchange Transactions is redisplayed with the list of the transactions filtered on their statuses.

For more information on the setup of selection filters for Forward Exchange Transactions, click here.

The FX transaction settlement is automatic for early settlement or carry forward. So, you do not have to do anything for this settlement. View topics Early Settlement and Carry Forward for more information.

You can settle the initial forward exchange transactions linked to an early settlement or to a carry forward, as well as the swap forward legs.

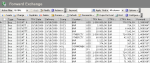

In the management page for Forward Exchange Transactions, double-click the lines corresponding to the transactions to select.

For more information on accessing the management page for Forward Exchange Transactions, see topic Forward exchange.

A transaction cannot be settled in the following situations (an error message appears):

- The accounts to debit and to credit for the transaction settlement have not been entered.

You need to enter these elements in the Settlement tab of the management page for Forward Exchange Transactions. For more information about this tab, click here.

- The transaction was not back-office validated.

For more information on back-office validation, see topic Back-office Validation.

In the actions toolbar, click on the Process menu, then the option:

- Settle if you selected a transaction,

- Settle by Batch if you selected several transactions.

The selected transactions are settled.

The transactions table is updated, the Status column now contains the "Settled" value for the selected lines, meaning that the corresponding transactions are settled.